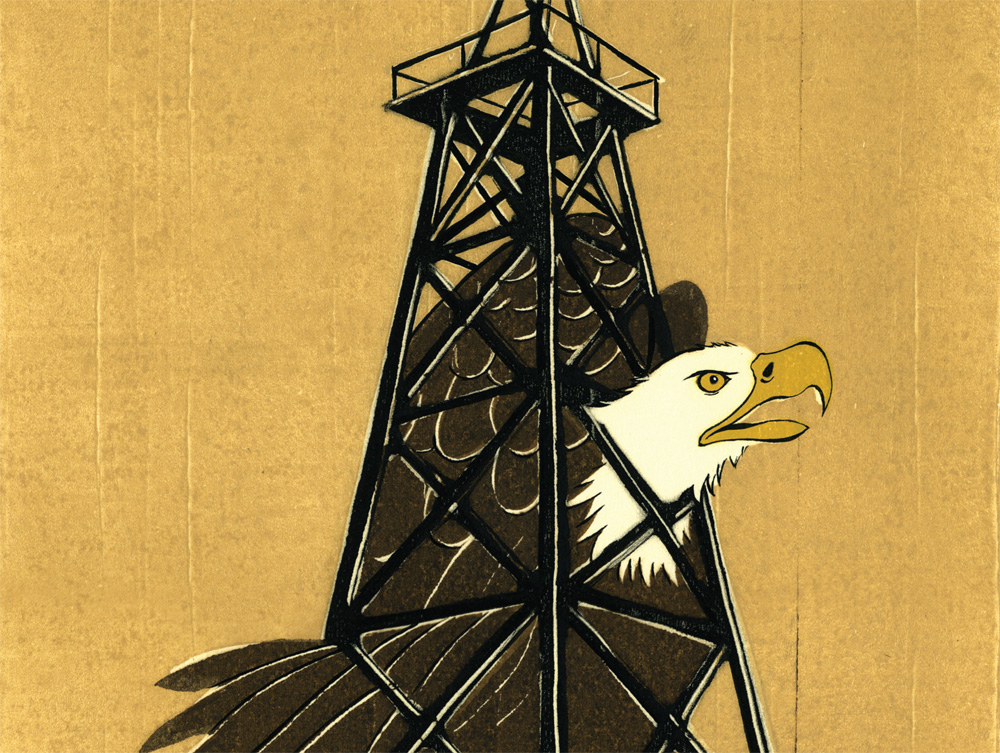

Adam Louis Shrier is not an armchair academic. Though he has degrees from Columbia University, M.I.T., Yale University, and Fordham University and teaches a course on the geopolitics of energy at Columbia’s School of International and Public Affairs, he has long been involved in the nitty-gritty process of getting things done, first as a manager at Exxon and later as an adviser to energy companies and governments in, among other places, Ukraine, Poland, Hungary, the Russian Far East, the Middle East, and most recently, China. The precipitous escalation in oil prices, he says, is sending a warning to the United States: The nation is too heavily dependent on “unsatisfactory” sources of foreign oil.

“We need to take action on energy,” he says. “The U.S. cannot single-handedly change world energy prices or attain energy independence. But it can certainly take steps to improve the ability of Americans to have the energy they need at a relatively attractive price.” However, he adds, taking such politically unpopular steps to curb demand or increase production, whether it be imposing higher taxes on gasoline, increasing fuel efficiency standards, or issuing more nuclear-energy plant permits, has stymied Washington’s ability to come up with an effective energy policy. “The political process [since the early 1980s] has argued in favor of not taking action. It’s easy to put off until the next administration,” he says.

This spring Congress was unable to reach consensus on energy legislation and focused its efforts on whom to blame for the high oil prices. Conservatives and liberals remain sharply divided about what has driven oil prices to nearly $150 a barrel.

Some Speculate

Guillermo Calvo is among those experts who think that much of the skyrocketing rise in price is due to financial speculation. A Columbia professor of international and public affairs (and president of the International Economic Association) who specializes in emerging markets, Calvo says that in recent years hedge and sovereign wealth funds with trillions of dollars at their disposal have shunned low-return investments in weak U.S. currency and bonds and poured money into commodities, especially oil. Some argue that this trading has pushed up the price of oil. Certainly, political pressure is mounting from both consumers and large corporations for Congress to regulate these largely opaque investments.

However, Columbia Business School professor Geoffrey Heal, along with the majority of experts who spoke to Columbia for this article, believes that current oil prices are primarily due to supply-and- demand issues. Global oil demand continues to rise at about 2 percent a year while supply, hampered by geopolitical tensions, remains tight. Recent stratospheric peaks are surprising, Heal says, but elevated prices are here to stay and there is little to be done about it. “I don’t think anything will turn it around. It’s just a fact of life. Oil is fairly scarce. A lot of people want it. The price is going to be high.”

In the oil market, with a more or less fixed supply (Saudi Arabia is one of the few countries that can increase production, and not by a significant amount), even a small rise in demand can set off an extraordinary price increase. “With most commodities,” Heal explains, “if the price had gone up by a factor of 13 the market would have collapsed totally. There’d be nobody left on the buying side. In the oil market we are basically using as much oil today at $130 a barrel as we did in 1998 at $10 a barrel. In economic terms, demand is incredibly inelastic, incredibly insensitive to price movements."

Dipping Point

That may be about to change. Lately, demand for gas in the U.S. has dipped by a percentage point or two. While that is good news, the demand for oil from growing economies in Asia and India has kept up pressure on gas prices and there is concern over how much longer U.S. consumers can afford to pay their bills and continue to buy goods. Home natural-gas prices, already up 77 percent since 2002, are now forecast by the Energy Information Administration to go up another 52 percent this year. Basic family necessities like milk, eggs (up 20 percent), and disposable diapers (some made with materials from Dow Chemical, which announced a 45 percent across-the-board price hike in June) are putting a strain on low-income families. In 2003, the average American family spent 4.8 percent of its income on energy expenses, but this year, according to one report, it will be nearly 15 percent.

In America’s heartland, people are coming to grips with these new economic realities. James B. Darnell ’79BUS, an assembly plant manager for General Motors for more than 20 years, now retired, lives in Cheboygan, Michigan, a small resort community that depends, economically, on the automobile industry centered in Flint, Lansing, and Detroit, more than 200 miles to the south. Darnell says that the local papers are full of news about truck-plant closings and that the streets and stores of Cheboygan are emptier this summer. “With gas prices so high it costs a lot of money to drive from Detroit to here, and that’s going to make a big impact on the community,” he says.

The latest downturn in the American auto industry, Darnell feels, is worse than the one precipitated by the oil crisis in the 1970s. “The ’70s were pretty bleak and dark. We got out of it, but this appears more severe. It appears that it’s going to require much more structural change in the auto industry. If you’ve got to stop making trucks and start making battery-powered hybrids and cars run by fuel cells, that’s a big switch in plant and equipment and you are looking at years to be able to accomplish that. You wonder if the car companies are going to run out of money before they get to that point,” he says.

Darnell believes that a lack of political will is hampering progress. “If we could just set a sane energy policy and go ahead and do it — pursue alternative energy sources — some of our energy and economic problems would get squared away.” A local initiative to start a windmill farm near Cheboygan, Darnell says, was quashed by new county regulations passed by residents who were concerned about their backyard views. Nuclear energy, too, is not popular in the area. Meanwhile, house sales have come to a screeching halt and the high-school students whom Darnell mentors are having problems finding any jobs. “There’s a big black cloud on the horizon,” he says.

Silver Lining

As gloomy as the economic picture appears, Heal points out, the consequences of high oil prices are not all bad. “Obviously there is a downside. From a distribution perspective, it’s regressive in that it will hurt low-income groups more than it will hurt high-income groups. So that is unfortunate. But more broadly, it’s going to help wean us off of fossil fuels.”

Already, skyrocketing gas prices are having an effect on energy-consumption behavior. In March, Americans drove 4.3 percent fewer miles than the year before. It was the sharpest drop ever reported by the Federal Highway Administration, representing 11 billion fewer miles driven and continuing a five-month driving-trend decline. Amtrak and public transportation ridership is reported to be up as much as 10 to 15 percent in some areas. Municipalities are encouraging their employees to carpool, and utilities are taking conservation measures, like installing “smart” meters in their customers’ homes.

“We are going to see in the next 10 years a huge transformation of the American energy industry, which will change the way we use energy in our daily lives and provide vast numbers of job opportunities in the alternative energy field,” says Heal.

In the last two years, high oil prices have spurred venture-capital firms to more than double their investment in alternative energy, which is seen by many as a new high-technology opportunity, akin to the Internet technology boom of the 1990s. Wind and solar power usage is growing by 15 to 20 percent a year, though after decades of development, these sources still represent less than 1 percent of the nation’s total energy consumption. Ethan E. Silverman ’83BUS, a partner at Wexford Capital, a hedge fund and private equity firm based in Greenwich, Connecticut, has seen stock prices in solar and wind power rise five- or sixfold in the past two years, but remains wary of their promise. “It’s a very, very far-fetched notion that any of these various forms of alternative energy — wind power, solar power, biofuels — in the near term, meaning the next five years, will have any significant impact on reducing usage of oil. It’s a nice political dream,” he says.

Perhaps, but in some parts of the world, like Denmark, where 20 percent of energy consumption is derived from wind power, and in France, where more than 75 percent comes from nuclear power, the challenges of developing alternative sources of energy already are being met.

Party’s Over

Kenneth T. Jackson, a Columbia professor of history whose books on cities and suburbs have helped define the historical ebb and flow between urban and suburban areas in America, thinks that the nation has been spoiled. Inexpensive gas and transportation costs, he says, have gotten Americans used to going where they wanted when they wanted. “We are a nation of movers,” he says. “In the United States, using inexpensive energy has created a spread-out environment of work, residence, and shopping that is almost unique in the world. For so long it was the glory of America, now it’s becoming in some ways the burden of America.” The U.S., Jackson says, imports 11 million barrels of oil a day. “It’s tough,” he adds. “Whether it’s $100, $130, or $150, every one of those barrels has to be paid for and it’s money that America doesn’t have, so we borrow to pay for the oil.”

In May and June, oil prices broke records previously reached in the early 1980s and in 1859. The energy economy is now in uncharted waters and this has some experts worried. The government, they feel, never has been very effective at controlling energy consumption and in the current environment there is intense pressure for Congress and the administration to do something. Last year Congress passed the Energy Independence and Security Act, which mandated higher gas mileage requirements and an increase in the use of renewable fuels. While few quarrel about the need for more fuel-efficient cars (in Europe, cars average 40 mpg, nearly double the U.S. average of 20.4 mpg), there is already intense political debate about price controls, market regulations, opening up offshore and Arctic conservation areas for drilling, and the merits of biofuel corn subsidies and tariff barriers.

Silverman, at Wexford Capital, hopes that energy and economic realities will dictate what he sees as a common-sense approach. “Congress is going to wake up and say, ‘There is no way we are going to have a third of the corn crop production used for ethanol.’ They are going to drop the tariffs and bring in the low-price sugar cane ethanol from Brazil. And the U.S. is going to wake up and realize it has to go nuclear. The environmentalists will go crazy, but nuclear energy is clean, it’s smart. France relies on it. It is the right answer.”

Whether or not the government will eventually help find the “right” alternative energy answer or not is currently being overshadowed by the immediate impact of surging oil prices on the Federal Reserve’s monetary policies. Professor Calvo says that spiraling oil prices have put the Fed in a precarious position.

“The Fed is fighting two fires, inflation on the one hand and financial collapse on the other,” he says. “To combat inflation, the Fed may have to increase interest rates very sharply, but that will increase liquidity problems just as we are recovering from the credit market crisis. That, in turn, may reignite the financial problems and shut down the economy and investment in emerging markets,” compounding chances of a worldwide recession.

Calvo believes that, if the past is any guide, the current record-high price of oil is a temporary phenomenon. As the tipping price is reached, consumption behavior will change; demand will lower both here and abroad, bringing prices back down to a more sustainable level, though never back to where they once were.

Shrier says the government can help make these lower prices happen. “The underlying upward trend in prices comes from the perception that we are going to have a tight supply for the next five years. In a tight market there are waves of pessimism and optimism depending on news and action. If a signal is sent that the U.S. government is firmly committed to bringing in more alternative energy and increasing domestic supply, that will have an effect on the oil-price market and there won’t be so much built-in speculation in anticipation of higher future prices.”