Among all universities and foundations with endowments of at least $1 billion, Columbia has earned the best returns on its investments over the past eight years.

That’s apparent from financial statements released last fall. Columbia’s investments earned a 12.1 percent annualized rate of return for the eight-year period between fiscal years 2004 and 2011; among all 94 universities and foundations with $1 billion–plus endowments, the median annualized average return was 7.7 percent.

“Columbia has adopted an investment strategy that is explicitly designed to deliver long-term results,” says Robert Kasdin, the University’s senior executive vice president. “So it’s remarkable that our investment team has tended to outperform both in years when the capital markets have been strong and when they’ve been weak. Typically, you’d expect to outperform only in parts of the market cycle, depending on the asset allocation and how much risk is in the portfolio. But Columbia did very well in the years leading up to the financial crash of 2008, it suffered less during the recession, and it has done exceptionally well since the markets have recovered.”

In fact, in each of the past two years, Columbia’s investments have performed better than those of all other Ivies, earning 17.3 percent in fiscal 2010 and 23.6 percent in fiscal 2011. These strong returns, together with new gifts made to the endowment, brought the fund’s value to $7.8 billion as of June 30, 2011, well exceeding its pre-crash peak of $7.4 billion in 2007.

Gifts that keep giving

Columbia’s endowment is a collection of money and financial assets donated to the University for long-term investment. It consists of 4,500 separate funds — many established by donors to support specific scholarships or faculty chairs, for example — that are invested as a single pooled investment account, much like a unitized mutual fund.

This year, payouts from Columbia’s endowment earnings will cover about $390 million, or 12 percent, of the University’s roughly $3.3 billion annual operating budget. Exactly how much Columbia spends from its endowment earnings each year is determined by financial guidelines adopted by the Board of Trustees, reflecting both the asset value of the endowment and the rate of inflation. In a typical year, this amounts to about 5 percent of each endowed fund’s total value being paid out. Columbia officials say the endowment’s growth in recent years has helped the University keep pace with the rising costs of higher education — which have gone up faster than inflation — while limiting the University’s reliance on student tuition.

“Growing the size of the endowment benefits the entire University,” says Kasdin. “The funds generated by our investment portfolio are a perpetual source of funding for student financial aid, which, for instance, has helped Columbia maintain its need-blind admission policy for College and engineering undergraduates. They also support capital projects, research, the libraries, and hundreds of professorships and dozens of academic centers and institutes in perpetuity.”

Although Columbia’s endowment has done exceptionally well in recent years, it is much smaller than the endowments of other top universities. Harvard has an endowment of $32 billion, Yale $19 billion, and Stanford and Princeton $17 billion each. These schools draw much larger payouts from their endowments, in dollar terms, than Columbia does each year.

Columbia, like any institution seeking to increase the size of its endowment, has a twin strategy: raise money and invest it wisely. The University’s fundraisers, for their part, have made soliciting gifts for the endowment a key goal of the ongoing Columbia Campaign. Of the $4.6 billion raised through the campaign in the past seven years, about $1.8 billion has been committed to the endowment, mostly for financial aid and faculty chairs.

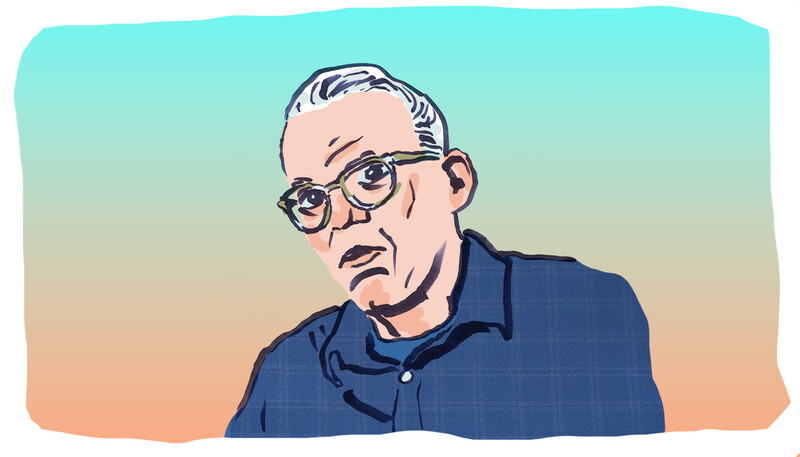

What explains Columbia’s investment success? According to Kasdin, one must look back to 2002, when the University created a nonprofit subsidiary, the Columbia Investment Management Company (IMC), to handle its investments. Until then, this work was done by a small group of investors in the central administration. The IMC, which employs twenty people, is nearly twice the size of that previous group. To lead the new team, Columbia recruited N. P. “Narv” Narvekar, who previously helped manage the University of Pennsylvania’s endowment and had fourteen years of Wall Street experience. The University gave Narvekar’s team a degree of independence: rather than reporting to Columbia’s central administration, the IMC takes its direction from a board whose members include leading investment experts among the University’s alumni and Trustees, in addition to a few senior Columbia administrators.

It is in the eight fiscal years since the IMC’s creation that Columbia’s endowment has outperformed all its peers.

“The Investment Management Company’s independence has been important to its success,” says Mark Kingdon ’71CC, a Columbia Trustee who is the president and founder of Kingdon Capital Management and chairs the IMC board. “Narv and his team are able to focus on their primary mission, attaining strong investment returns over long stretches of time. They are highly disciplined, independent thinkers who don’t try to imitate what other investors are doing. They have a deep understanding of risk management, and do an excellent job of finding and monitoring superior managers for the University’s endowment.”

Thinking long-term

The IMC is located on the sixty-third floor of the Chrysler Building in midtown Manhattan, in a beige, sparsely decorated suite whose plainness comes as a shock after you enter through the building’s luxurious Art Deco lobby. On a recent Monday afternoon, the mood in the office was subdued, as small groups of studious-looking investors huddled around computer screens, calmly discussing the prospects of various stocks, bonds, private equities, and commodities. It was hardly the hectic scene you might expect to find in an investment firm.

“The primary mission the University has given us is to deliver long-term results,” says Narvekar, the president and chief executive officer of the IMC. “This is an advantage in the broader market. We make every effort to avoid the distractions of quarterly or even yearly returns.”

Narvekar insists there’s no easy explanation for how his team has achieved exceptional returns compared to other university endowment managers. In many ways, he says, the IMC is similar to the management companies that handle the endowments of most other top universities. For instance, its employees don’t invest much money in the market themselves; rather, they hire third-party managers to do so.

Peter Holland, the IMC’s chief investment officer, explains: “Our in-house investment professionals are focused on larger strategic questions, such as, should we have more or less exposure to government bonds in our portfolio? How about stocks? Real estate? Commodities or emerging markets? If we decide we’re interested in Brazilian equities, one of our staff members will likely take a few trips down there to study the business landscape and then interview lots of potential partners. We’ll choose a manager who deeply understands that market.”

One of the IMC’s distinct advantages, Narvekar and Holland say, is that their staff has spent the past eight years developing a systems platform that enables IMC analysts to efficiently assess both the performance of their third-party managers and the endowment’s exposure to various types of assets held in their portfolios. “If we want to know how much risk a particular manager has taken, or how his returns rate against those of his peers in a particular market, we can compute that very easily and quickly,” says Holland. “If we need to determine how much risk exposure we have, say, in Europe, it’s remarkably easy for us to assess that and respond accordingly.”

A key strategic decision that has paid off in recent years, Narvekar says, is that the IMC has been careful to maintain its liquidity, which turned out to be crucial in 2008. “When the market declined, some institutions were forced to sell off assets in order to pay their bills, which probably exacerbated their losses,” he says. “Columbia didn’t face that kind of cash-flow problem.”

The University’s endowment did lose about 16 percent of its value in fiscal 2008, yet this represented a much smaller loss than those incurred by some other prestigious schools. As a result, Columbia weathered the recession without making drastic cuts to its programs or staffing. “Our ability to achieve academic excellence in the highest tier with several peer institutions that have far larger endowments than our own,” says President Lee C. Bollinger, “has been greatly aided by our relative financial stability during these turbulent years.”